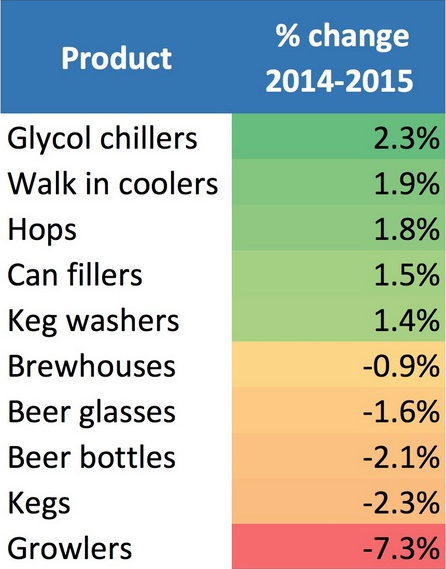

Being able to look at what breweries purchase is essential in determining the future trends and to map where the craft beer industry is headed.

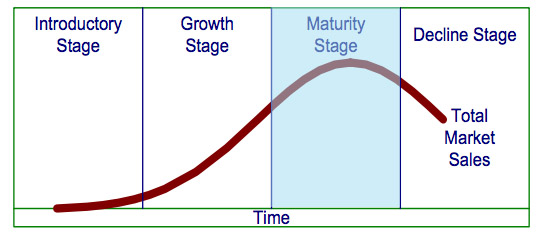

Breweries continue to make strategic expansion-minded purchasing decisions and are improving their facilities. As the craft beer market segment heads solidly into the mature stage of the industry’s life cycle, cans are in, growlers are out and consumers are creating demand for where they want to make their craft beer purchases.

Kinnek, which bills itself as “the ultimate craft brewery purchasing marketplace,” compiled the following information and you can find more about their numbers here.

The information we’ll be analyzing here is the percent change in the most and least requested craft brewing supplies within the Kinnek marketplace in 2015 (compared to 2014).

The number that seems to be most shocking is the -.9% change in brewhouse sales. This number could indicate that brewery openings have started to slow down across the country.

But this number could also mean that breweries have started to expand smarter and, instead of upgrading to new brewhouses every couple of years, they’ve made larger and more exponential growth decisions to sustain operations for the next five to ten years.

I’d like to believe that it’s a combination of both but I don’t feel that a less than 1% drop is significant, for now. We will know more by reviewing this data over the next couple of years.

Kinnek’s data also showed that growler sales to breweries may have decreased by 7.3% – but I see this as a positive.

When craft beer was in its early stages of development, there weren’t many options for consumers in bars or supermarkets. This need created the birth of the growler so that customers could take their favorite local craft beers home with them.

The decrease in growler sales to breweries simply indicates that there is no longer a necessity to get beer straight from your local brewery. Packaging and distribution efforts by breweries have paid off and, as the craft beer movement has picked up steam, supermarkets now carry many local and national craft brands. Going to your local brewery to buy a growler has become less convenient and that’s a good sign for the industry.

Kinnek’s purchasing table is representative of how breweries are choosing to expand.

Instead of simply making more beer they are deciding to focus on packaging and distribution. The significant increases in “walk in coolers” (+1.9%), “glycol chillers” (+2.3%) needed to keep coolers and fermenters cold and “can fillers” (+1.5%) prove this. The decrease in “beer bottles” (-2.1%) simply shows the increase in popularity of cans and is not an indicator of how packaged beer is performing.

Breweries, according to the information provided by Kinnek, have started to build their facilities and focus on weak points in their operations. Packaging has always been a difficult and expensive undertaking but as the demand for craft beer continues to grow breweries have invested in their facilities.

Purchasing trends are going to give us a snapshot that’s ahead of the curve because breweries have a direct relationship with consumers and are able to predict what demand will be for in the future.

All of the data, so far, suggests great things for the craft beer industry as it begins to mature.

American Craft Beer The Best Craft Beer, Breweries, Bars, Brewpubs, Beer Stores, And Restaurants Serving Serious Beer.

American Craft Beer The Best Craft Beer, Breweries, Bars, Brewpubs, Beer Stores, And Restaurants Serving Serious Beer.